The Philippines is known for its vibrant and festive celebration of Christmas, a holiday that is deeply ingrained in the country's culture and traditions. As the holiday season approaches, employees and employers alike are eager to know the rules surrounding Christmas holiday pay. In this article, we will delve into the specifics of Christmas holiday pay rules in the Philippines, providing guidance for both employees and employers.

Christmas Holiday Pay in the Philippines

The Philippines celebrates several holidays throughout the year, and Christmas is one of the most significant. According to the Philippine Labor Code, Christmas Day, which falls on December 25, is a regular holiday. This means that employees are entitled to a day off, and those who work on this day are entitled to holiday pay.

Holiday Pay Rules

The holiday pay rules in the Philippines are governed by the Philippine Labor Code and the implementing rules and regulations. According to these rules, employees are entitled to holiday pay if they meet certain conditions.

For regular holidays, such as Christmas Day, employees are entitled to a holiday pay of 100% of their daily wage rate, provided they are not absent on the day before and the day after the holiday. This means that if an employee works on Christmas Day, they will receive their regular daily wage plus an additional 100% of their daily wage as holiday pay.

However, if an employee is absent on the day before or the day after the holiday, they will not be entitled to holiday pay. This is unless they can provide a valid reason for their absence, such as illness or injury.

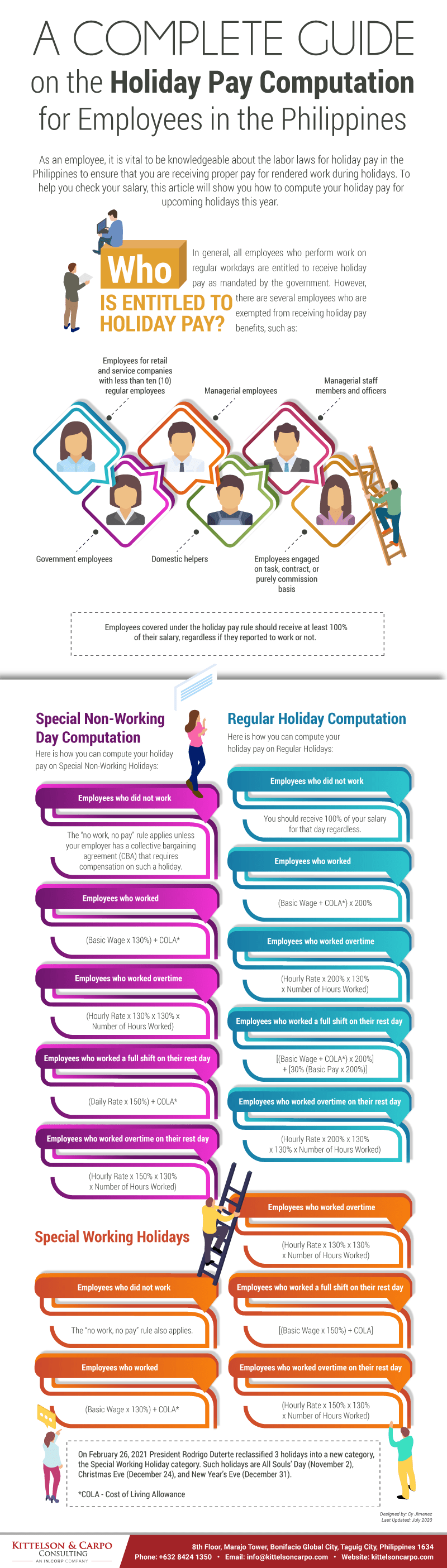

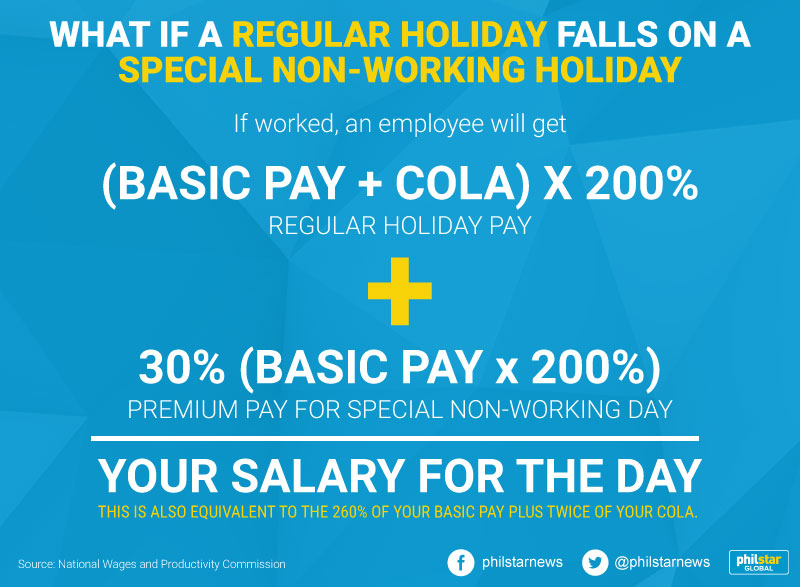

Special Holiday Pay Rules

In addition to regular holidays, the Philippines also celebrates special holidays, which include December 24 (Christmas Eve) and December 31 (New Year's Eve). While these days are not regular holidays, employees are still entitled to a special holiday pay of 30% of their daily wage rate.

Night Shift Differential and Holiday Pay

Employees who work night shifts on Christmas Day are entitled to a night shift differential of 10% of their hourly wage rate. This is in addition to their holiday pay.

Holiday Pay for Part-Time and Probationary Employees

Part-time and probationary employees are also entitled to holiday pay, provided they meet the same conditions as regular employees. However, their holiday pay will be based on their actual hours worked on the holiday.

Computation of Holiday Pay

The computation of holiday pay in the Philippines is based on the employee's daily wage rate. The daily wage rate is calculated by dividing the employee's monthly wage by the number of days in the month.

For example, if an employee's monthly wage is PHP 20,000 and the number of days in the month is 30, their daily wage rate would be PHP 666.67. If they work on Christmas Day, their holiday pay would be PHP 1,333.34 (100% of their daily wage rate).

Benefits of Holiday Pay

Holiday pay provides several benefits to employees, including:

- Additional income: Holiday pay provides employees with an additional source of income, which can be used to meet their financial needs.

- Time off: Holiday pay gives employees time off to relax and recharge, which can improve their productivity and overall well-being.

- Work-life balance: Holiday pay allows employees to spend quality time with their families and friends, which can improve their work-life balance.

Best Practices for Employers

Employers can follow best practices to ensure compliance with holiday pay rules and to promote a positive work environment. These include:

- Providing clear communication: Employers should provide clear communication to employees about holiday pay rules and policies.

- Ensuring accurate computation: Employers should ensure accurate computation of holiday pay to avoid errors and disputes.

- Providing time off: Employers should provide employees with time off to relax and recharge.

- Promoting work-life balance: Employers should promote work-life balance by allowing employees to spend quality time with their families and friends.

Gallery of Philippine Holiday Pay Rules

Frequently Asked Questions

What is holiday pay in the Philippines?

+Holiday pay in the Philippines is a payment made to employees for working on a holiday.

What are the holiday pay rules in the Philippines?

+The holiday pay rules in the Philippines are governed by the Philippine Labor Code and the implementing rules and regulations.

How is holiday pay computed in the Philippines?

+The computation of holiday pay in the Philippines is based on the employee's daily wage rate.

In conclusion, holiday pay rules in the Philippines are designed to provide employees with additional income and time off to relax and recharge. Employers should ensure compliance with these rules and promote a positive work environment by providing clear communication, accurate computation, and time off. By understanding these rules, employees can make the most of their holiday pay and enjoy the festive season with their loved ones.