As the holiday season approaches, many employees in Texas may be wondering about their holiday pay and Christmas pay laws. While federal law requires certain employers to provide holiday pay, the specifics can vary depending on the state and the type of employer. In Texas, holiday pay laws are governed by the Fair Labor Standards Act (FLSA) and state-specific regulations. In this article, we will delve into the details of holiday pay in Texas, including Christmas pay laws and other relevant information.

Holiday Pay Laws in Texas

The FLSA requires most employers to provide holiday pay to their employees on certain federal holidays. These holidays include New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day. However, the FLSA does not require employers to provide paid holidays for other holidays, such as Good Friday or Easter Monday.

In Texas, employers are not required to provide holiday pay to their employees, unless they have a contract or collective bargaining agreement that requires it. However, many employers in Texas choose to provide holiday pay to their employees as a benefit.

Christmas Pay Laws in Texas

Christmas Day is one of the federal holidays that is covered under the FLSA. If an employer is required to provide holiday pay under the FLSA, they must provide it to their employees on Christmas Day. However, the amount of holiday pay that an employer is required to provide can vary.

Under the FLSA, employers are required to provide holiday pay at the employee's regular rate of pay. This means that if an employee normally earns $20 per hour, they would be entitled to $20 per hour in holiday pay.

Some employers in Texas may also choose to provide additional benefits to their employees during the holiday season, such as a Christmas bonus or extra time off. These benefits are not required by law, but can be a way for employers to show appreciation for their employees' hard work.

Who is Entitled to Holiday Pay in Texas?

Not all employees in Texas are entitled to holiday pay. Under the FLSA, employers are only required to provide holiday pay to employees who are exempt from overtime pay. This typically includes employees who are paid a salary rather than an hourly wage.

However, some employers in Texas may choose to provide holiday pay to all of their employees, regardless of their exempt status. This is a benefit that is typically negotiated as part of an employment contract or collective bargaining agreement.

Do Employers Have to Pay for Holiday Time Off?

In Texas, employers are not required to pay employees for holiday time off, unless they have a contract or collective bargaining agreement that requires it. However, many employers choose to provide paid time off during the holiday season as a benefit to their employees.

Under the FLSA, employers are only required to provide paid time off for holidays that are specifically designated as federal holidays. This means that if an employer chooses to close on a day that is not a federal holiday, they are not required to pay their employees for that time off.

How Much Holiday Pay Do Employers Have to Pay?

The amount of holiday pay that an employer is required to pay can vary. Under the FLSA, employers are required to pay their employees at their regular rate of pay for holiday time. This means that if an employee normally earns $20 per hour, they would be entitled to $20 per hour in holiday pay.

However, some employers in Texas may choose to provide additional benefits to their employees during the holiday season, such as a Christmas bonus or extra time off. These benefits are not required by law, but can be a way for employers to show appreciation for their employees' hard work.

What are the Most Common Holidays in Texas?

While federal law requires employers to provide holiday pay on certain federal holidays, some employers in Texas may choose to provide additional holidays off to their employees. Here are some of the most common holidays in Texas:

- New Year's Day (January 1st)

- Memorial Day (Last Monday in May)

- Independence Day (July 4th)

- Labor Day (First Monday in September)

- Thanksgiving Day (Fourth Thursday in November)

- Christmas Day (December 25th)

Some employers in Texas may also choose to provide additional holidays off to their employees, such as:

- Good Friday

- Easter Monday

- Martin Luther King Jr. Day

- Presidents' Day

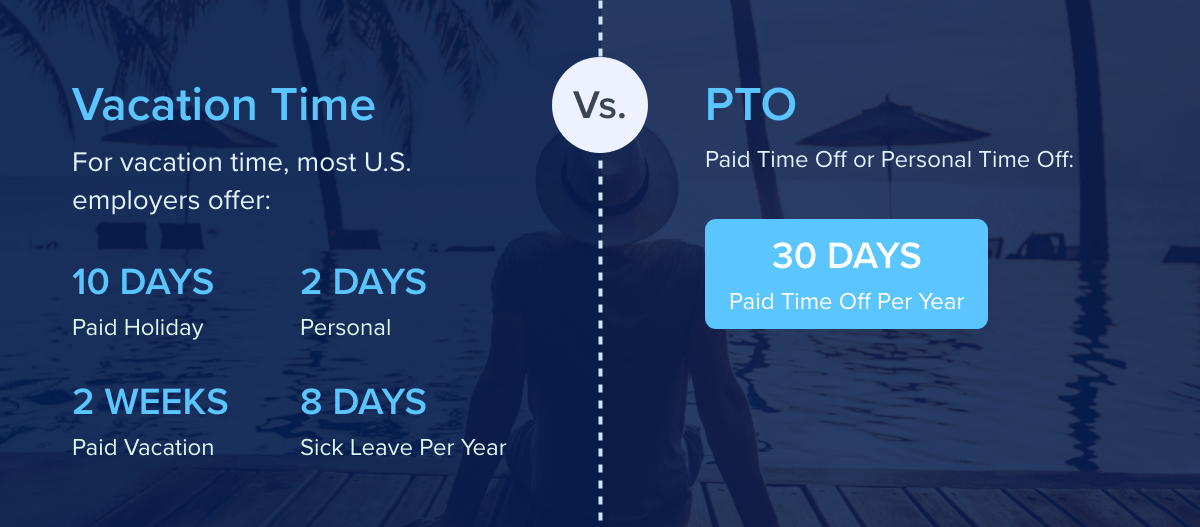

What is the Difference Between a Holiday and a Paid Time Off (PTO) Day?

While holiday pay and paid time off (PTO) days are both benefits that employers may provide to their employees, they are not the same thing. Holiday pay is typically provided on specific federal holidays, such as Christmas Day or Thanksgiving Day. PTO days, on the other hand, are days that employees can take off from work for any reason, such as vacation or personal time.

In Texas, employers are not required to provide PTO days to their employees. However, many employers choose to provide PTO days as a benefit to their employees.

How Do I Calculate Holiday Pay in Texas?

Calculating holiday pay in Texas can be a bit complex. Here's a step-by-step guide:

- Determine the employee's regular rate of pay. This is the amount that the employee normally earns per hour.

- Determine the number of hours the employee worked on the holiday. This can include overtime hours.

- Multiply the employee's regular rate of pay by the number of hours they worked on the holiday.

- Add any additional benefits, such as a Christmas bonus or extra time off.

For example, let's say an employee normally earns $20 per hour and works 8 hours on Christmas Day. Their holiday pay would be:

$20 per hour x 8 hours = $160

If the employer also provides a Christmas bonus of $100, the employee's total holiday pay would be:

$160 + $100 = $260

Can I Take Time Off During the Holiday Season?

Yes, you can take time off during the holiday season. In fact, many employers in Texas provide paid time off during the holiday season as a benefit to their employees.

However, the amount of time off you can take will depend on your employer's policies and the type of leave you are taking. Here are some common types of leave that employers in Texas may provide:

- Vacation time: This is time off that you can take for any reason, such as vacation or personal time.

- Sick leave: This is time off that you can take when you are ill or injured.

- Family leave: This is time off that you can take to care for a family member who is ill or injured.

- Holiday time: This is time off that you can take on specific holidays, such as Christmas Day or Thanksgiving Day.

What Happens If I Work on a Holiday?

If you work on a holiday, you may be entitled to holiday pay. However, the amount of holiday pay you receive will depend on your employer's policies and the type of holiday.

Under the FLSA, employers are required to pay employees at their regular rate of pay for holiday time. However, some employers in Texas may choose to provide additional benefits to their employees who work on holidays, such as overtime pay or a holiday bonus.

Can I Get Fired for Taking Time Off During the Holiday Season?

While it's unlikely that you would get fired for taking time off during the holiday season, it's possible. If you take time off without your employer's approval, you may be subject to disciplinary action, including termination.

However, if you have a contract or collective bargaining agreement that requires your employer to provide paid time off during the holiday season, you may have grounds to dispute any disciplinary action.

What is holiday pay in Texas?

+Holiday pay in Texas is pay that employers provide to their employees on specific holidays, such as Christmas Day or Thanksgiving Day.

Do employers in Texas have to provide holiday pay?

+No, employers in Texas are not required to provide holiday pay, unless they have a contract or collective bargaining agreement that requires it.

How much holiday pay do employers have to pay in Texas?

+The amount of holiday pay that employers in Texas have to pay can vary. Under the FLSA, employers are required to pay employees at their regular rate of pay for holiday time.