As the holiday season approaches, many individuals and families are preparing for the added expenses that come with Christmas. For those who may be struggling to make ends meet, H&R Block's Christmas Loan program can provide some much-needed financial relief. However, before applying for this loan, it's essential to understand the requirements and qualifications necessary to be eligible. In this article, we'll explore the five key requirements for the H&R Block Christmas Loan 2024.

Applying for a loan can be a daunting task, especially during the holiday season when finances are already stretched thin. H&R Block's Christmas Loan program aims to provide a helping hand to those in need, but it's crucial to understand the terms and conditions of the loan before applying. By meeting the necessary requirements, borrowers can ensure a smooth and successful application process.

In this article, we'll delve into the five key requirements for the H&R Block Christmas Loan 2024, including income requirements, credit score requirements, loan amounts, repayment terms, and additional documentation needed.

Income Requirements

To be eligible for the H&R Block Christmas Loan 2024, applicants must meet specific income requirements. These requirements vary depending on the borrower's state of residence and the loan amount applied for. Generally, borrowers must have a minimum gross income of $1,000 to $3,000 per month, depending on the loan amount.

For example, if a borrower is applying for a loan of $1,000, they may need to have a minimum gross income of $1,500 per month. On the other hand, if a borrower is applying for a loan of $2,500, they may need to have a minimum gross income of $3,000 per month.

It's essential to note that these income requirements are subject to change, and borrowers should check with H&R Block directly for the most up-to-date information.

Acceptable Income Sources

H&R Block accepts various income sources, including:

- Employment income

- Self-employment income

- Retirement income

- Disability income

- Unemployment benefits

Borrowers will need to provide proof of income, such as pay stubs, W-2 forms, or tax returns, to support their loan application.

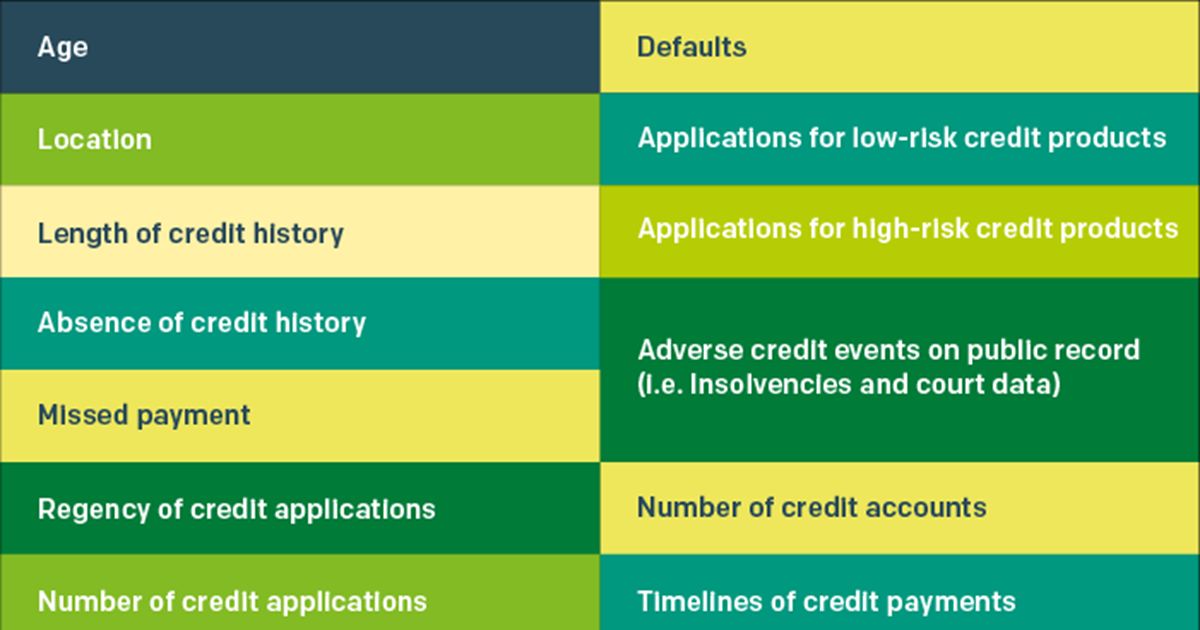

Credit Score Requirements

While H&R Block does not have a minimum credit score requirement, borrowers with poor credit may be subject to higher interest rates or stricter repayment terms. Typically, borrowers with a credit score of 620 or higher may be eligible for more favorable loan terms.

However, it's essential to note that H&R Block uses a proprietary credit scoring model to evaluate creditworthiness. This model takes into account various factors, including credit history, income, and debt-to-income ratio.

How to Improve Your Credit Score

If you're concerned about your credit score, there are several steps you can take to improve it:

- Make on-time payments

- Reduce debt

- Avoid applying for multiple credit cards or loans

- Monitor your credit report for errors

By improving your credit score, you may be eligible for more favorable loan terms, including lower interest rates and more flexible repayment options.

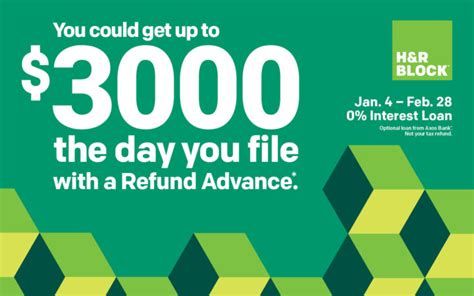

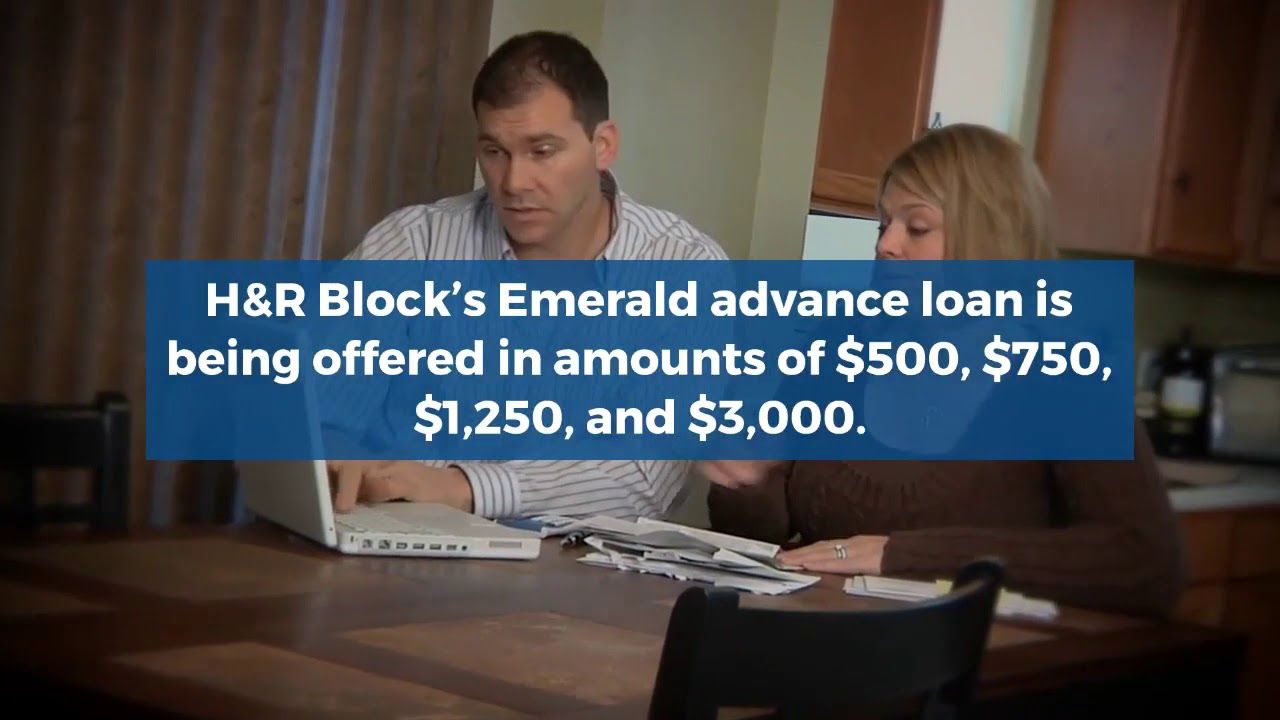

Loan Amounts

The H&R Block Christmas Loan 2024 offers loan amounts ranging from $1,000 to $3,500, depending on the borrower's state of residence and income level. Borrowers can choose from various loan amounts, including:

- $1,000

- $1,500

- $2,000

- $2,500

- $3,000

- $3,500

It's essential to note that loan amounts may vary depending on the borrower's creditworthiness and income level.

Repayment Terms

The repayment terms for the H&R Block Christmas Loan 2024 vary depending on the loan amount and borrower's creditworthiness. Typically, borrowers can choose from repayment terms ranging from 6 to 12 months.

For example, if a borrower applies for a loan of $2,000, they may be eligible for a 9-month repayment term with monthly payments of $222. However, if a borrower applies for a loan of $3,500, they may be eligible for a 12-month repayment term with monthly payments of $292.

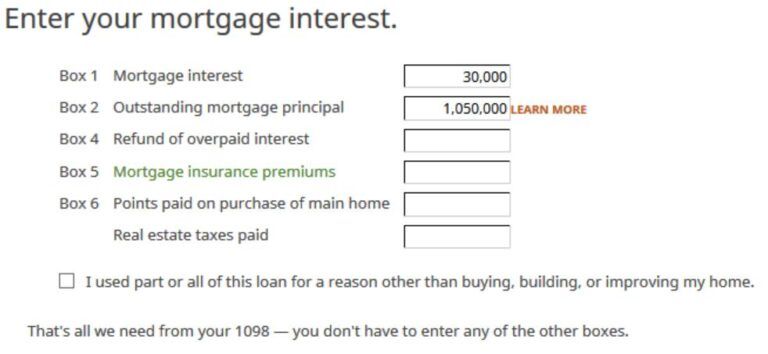

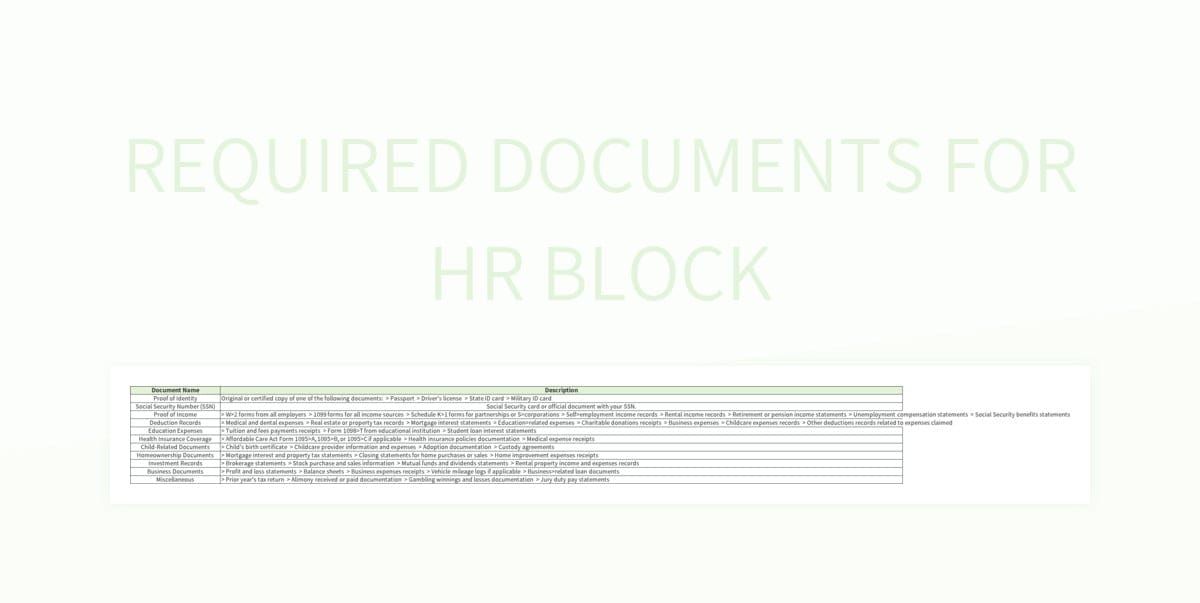

Additional Documentation Needed

To complete the loan application process, borrowers may need to provide additional documentation, including:

- Proof of income (pay stubs, W-2 forms, tax returns)

- Proof of identity (driver's license, state ID, passport)

- Proof of residency (utility bills, lease agreement, bank statements)

- Bank account information (account number, routing number)

Borrowers should check with H&R Block directly for a comprehensive list of required documentation.

By meeting the necessary requirements for the H&R Block Christmas Loan 2024, borrowers can ensure a smooth and successful application process. Remember to check with H&R Block directly for the most up-to-date information on income requirements, credit score requirements, loan amounts, repayment terms, and additional documentation needed.

We hope this article has provided you with a comprehensive understanding of the requirements for the H&R Block Christmas Loan 2024. If you have any further questions or concerns, please don't hesitate to reach out.

What is the minimum credit score required for the H&R Block Christmas Loan 2024?

+While H&R Block does not have a minimum credit score requirement, borrowers with poor credit may be subject to higher interest rates or stricter repayment terms.

How much can I borrow with the H&R Block Christmas Loan 2024?

+The H&R Block Christmas Loan 2024 offers loan amounts ranging from $1,000 to $3,500, depending on the borrower's state of residence and income level.

What is the repayment term for the H&R Block Christmas Loan 2024?

+The repayment terms for the H&R Block Christmas Loan 2024 vary depending on the loan amount and borrower's creditworthiness. Typically, borrowers can choose from repayment terms ranging from 6 to 12 months.