The holiday season is just around the corner, and many families are eagerly awaiting the Christmas tax credit payment. This payment is a vital source of financial support for millions of households, helping to ease the burden of festive expenses. In this article, we will delve into the Christmas tax credit payment dates, how to claim, and what to expect.

Understanding Tax Credits

Tax credits are a form of government support designed to help low-income families and individuals. They can be claimed by working individuals, including those who are self-employed, and can provide a significant boost to household finances. There are two types of tax credits: Working Tax Credit and Child Tax Credit.

Working Tax Credit

Working Tax Credit is a payment made to working individuals who are on a low income. To qualify, you must work a certain number of hours per week and earn below a certain threshold. The amount you receive will depend on your income, family circumstances, and number of hours worked.

Child Tax Credit

Child Tax Credit is a payment made to families with children. It is designed to help with the costs of raising a child and can be claimed by families with one or more children. The amount you receive will depend on your income, family circumstances, and the number of children you have.

Christmas Tax Credit Payment Dates

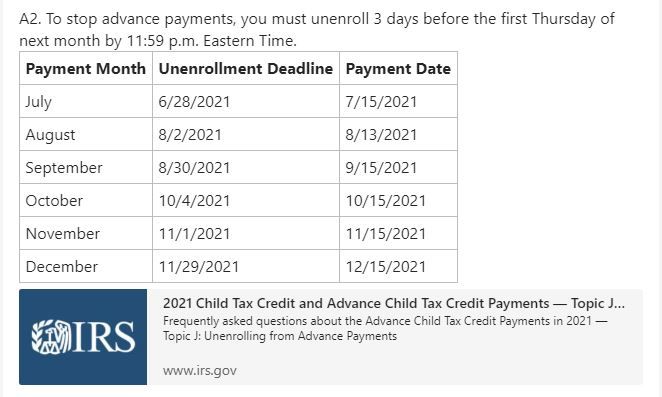

The Christmas tax credit payment dates have been revealed, and eligible households can expect to receive their payment on the following dates:

- For those receiving payments every 4 weeks, the Christmas payment will be made on December 23rd.

- For those receiving payments every 2 weeks, the Christmas payment will be made on December 21st and 28th.

- For those receiving payments every week, the Christmas payment will be made on December 20th, 27th, and January 3rd.

How to Claim Your Christmas Tax Credit Payment

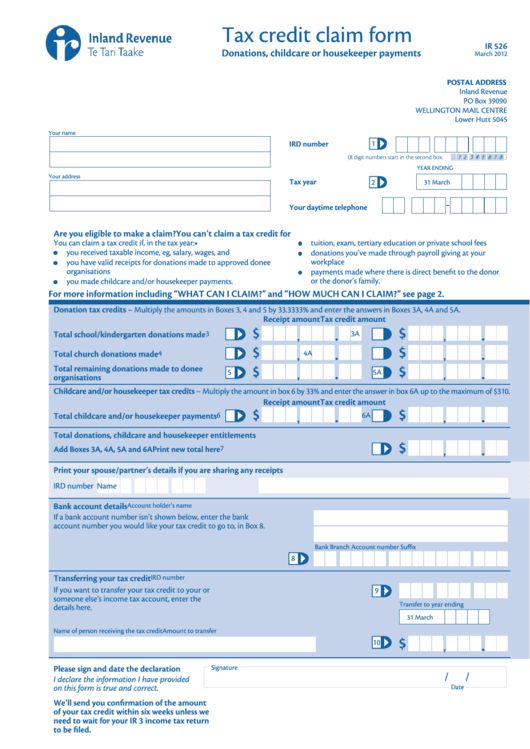

To claim your Christmas tax credit payment, you must first ensure that you are eligible. You can do this by checking the government's website or contacting your local tax office. If you are eligible, you will need to complete a tax credit claim form, which can be done online or by post.

Once you have submitted your claim, you will receive a payment schedule outlining the dates and amounts of your payments. You can choose to have your payment made into a bank account, building society account, or Post Office card account.

What to Expect from Your Christmas Tax Credit Payment

Your Christmas tax credit payment will be made in addition to your regular tax credit payments. The amount you receive will depend on your individual circumstances, but it is typically a one-off payment of around £10-£20.

It's essential to note that tax credit payments are subject to change, and the government may make adjustments to the payment amounts or dates. You can stay up-to-date with the latest information by checking the government's website or contacting your local tax office.

Tips for Managing Your Christmas Tax Credit Payment

While the Christmas tax credit payment can be a welcome boost to household finances, it's essential to manage your money wisely. Here are some tips for making the most of your payment:

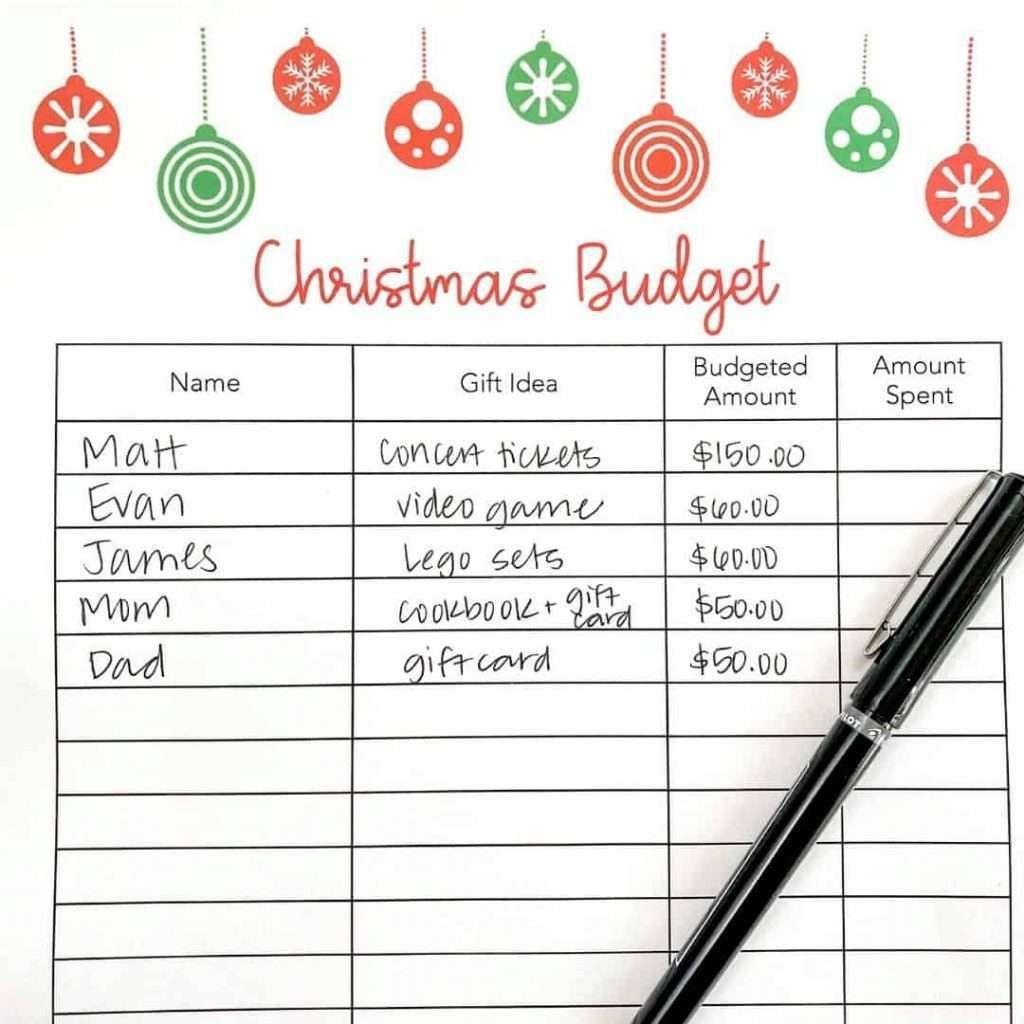

- Create a budget: Plan out your festive expenses and make a budget to ensure you don't overspend.

- Prioritize your spending: Focus on essential expenses, such as food and heating, before splurging on gifts or decorations.

- Save for the future: Consider putting some of your payment aside for future expenses, such as utility bills or rent.

Gallery of Christmas Tax Credits

Who is eligible for Christmas tax credits?

+Eligibility for Christmas tax credits depends on your individual circumstances, including your income, family circumstances, and number of hours worked. You can check your eligibility on the government's website or by contacting your local tax office.

How much will I receive in my Christmas tax credit payment?

+The amount you receive in your Christmas tax credit payment will depend on your individual circumstances. It is typically a one-off payment of around £10-£20.

Can I claim Christmas tax credits if I'm self-employed?

+Yes, self-employed individuals can claim Christmas tax credits. You will need to complete a tax credit claim form and provide information about your business and income.

We hope this article has provided you with valuable information about Christmas tax credit payment dates and how to claim. If you have any further questions or concerns, please don't hesitate to contact us.